My main technical objection to this rally (for fundamental objections, see pretty much the whole blog) since its second or third week has been its refusal to back and fill. The flat days and pullbacks have been few and far between, and the couple of strong selloff days since March have been followed up by furious buying. The markets have been irrational for a long while now, and anyone who will tell you that they’re panicking up any more rationally than they’ve been panicking down is a fool. The danger is that while investing consumers–who after all are supposed to benefit from the wisdom of institutional traders, which is why they pay their salaries and ridiculous bonuses–get hurt when the market drops, they risk to get hurt a lot more if they mistake a sucker’s rally for the real thing. I believe that companies doing, say, outsized program trading might be goosing this thing along to take advantage of precisely such suckerness. I’d rather people’s existing holdings get hurt further than that they get deluded into holding more at this point in our “recovery”. Full disclosure: I care more about real people getting screwed by trader activity than about traders’ bottom lines. (Even yours!)

But I digress. Whether the tape lies or not, whether endless upness without building real support is characteristic of bear market rallies or not, blah blah blah, for anything other than a short- to intermediate-term trade I’m looking for stubborn independence in a stock’s movement, and in the underlying company’s business. I’m looking for the non-nonsense. It’s an obvious fact that some companies really have bottomed, regardless of what you expect the market to do. It’s anyone’s guess which companies those are, and I’m not in the habit of making those calls, but I like a safe bet, if only as a nice idle thought in the midst of so much meaningless volatility. Don’t get me wrong, I’m not really a fundamentals guy, or at least not with any more weight than I give sentiment, and the chart still rules. But in the case of Powerwave, all three look pretty strong to me.

Powerwave is a telecom sector play. They operate worldwide, making all sorts of infrastructure components for PCS, 3G, and 4G networks, a reliable growth field (not that I need to point that out), especially as several U.S. carriers have committed to 4G. Their customer base is OEM manufacturers and wireless network operators. They’ve had three tough years as infrastructure demand has been all over the place, but as their 10-K from March 2009 details, they’ve taken the cue, began restructuring in 2006, and in particular spent the last half of 2008 getting leaner and meaner. They are expected to take further losses from that reorganization this quarter, but an average of analyst estimates (I don’t give a shit, but you might) show them with positive earnings on 2009, doubling in 2010.

I like this as a smartphone play, a stimulus/infrastructure play, and a tech-edge/trend play. In short, there are lots of reasons to like this, which is what I look for before classifying something as a long-term trade (>2 months to target) or (yikes!) an “investment”.

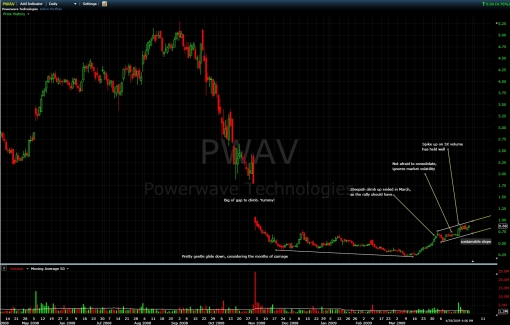

As for the charts (it’s huge, click to see), to me they look great. Sure, the same v-shaped recovery we’ve seen in the rest of the nonsense rally, but that has given way to almost a full month of sideways action, with one nice push up on 3x volume a week ago, and prices holding steady since, despite some very turbulent broader market action. As a small cap (132M shares) they’re not expected to tightly correlate to the markets, and while as I said I’m not in the call-making business I expect them to hold up well in what I am still fairly sure will be the coming weeks’ pullback/retest of lows. Note that earnings as reported by their sector ($AAPL, $RIMM, $NOK, $T, $VZ) are looking pretty darn rosy, all things considered. People with money to spend are hooked on the smartphone “lifestyle”. They are going to huff 4G like glue.

Over at CAPS you can pick up a nice summary of current sentiment and all sorts of stats and history on the company. Also available Yahoo (blech), MarketWatch (meh), and Google (yay!) style. Note that the CAPS user recommendations are quite outdated, but current analyst projections at MarketWatch look up to date. Plenty of news and PR links available at the three portal sites.

Near-term price resistance at $0.90, if you’re waiting for the next breakout. And they report earnings Monday, May 4 if you prefer to wait for the news. Should they “fail to meet expectations”, I’ll be taking that as a buying opportunity. And should they beat, I’ll be taking it much the same way.

Disclosure/Conclusion: Pretty damn long $PWAV. Lookin’ to get longer.